Americans will be gathering on the Fourth of July for a day of fireworks, food, parades and more. But as you celebrate with your friends and family this Independence Day, your cookout bill will be a bit higher.

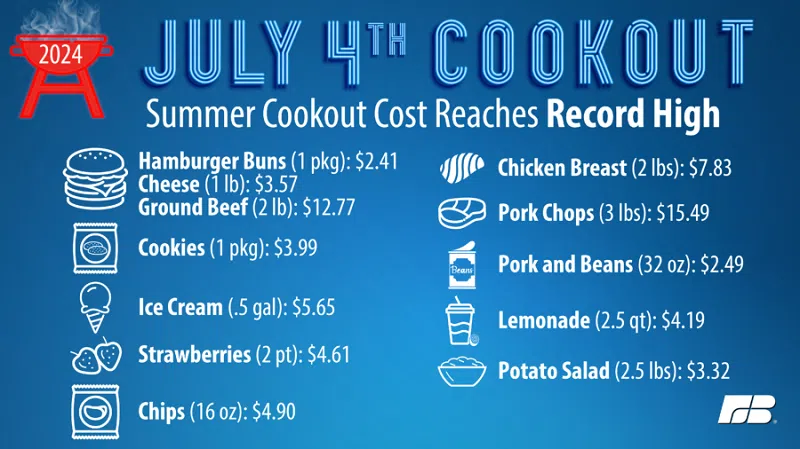

Volunteers from across the United States contributed to this year’s American Farm Bureau Fourth of July market basket survey to determine the average cost of summer cookout staples. The survey pulls prices for a complete, homemade cookout consisting of cheeseburgers, chicken breasts, pork chops, potato chips, pork and beans, fresh strawberries, homemade potato salad, fresh-squeezed lemonade, chocolate chip cookies and ice cream. With plenty of options to feed a hungry crowd, a group of 10 this year can expect to pay $71.22 for their celebration, up 5% from last year and up 30% from five years ago. Nationally, this means we are surpassing $7 per person for the first time, with the total meal coming to $7.12 a person. Only two dishes decreased in price while everything else on your table rose, on average. Your grocery bill may be a shock, but it is in line with the inflation that has roiled the economy – including the farm economy – over the last several years.

On the Grill

Meat will put the biggest dent in your grocery budget. Ground beef, pork chops and chicken breast account for 50% of the total cookout cost, as we see changes in the pork and beef industries having a big impact on supermarket prices.

This year, 2 pounds of ground beef will cost an average of $12.77, up more than $1, or 11%, from last year. While there are higher numbers of fed cattle in the supply chain this spring compared to 2023, the overall cattle inventory is the smallest it has been in 73 years and beef in cold storage is setting record lows for recent years. As we head into the heart of the summer, fewer cattle are being placed on feed, but more are heading to the grocery store shelves. Fewer cattle also mean there won’t be as much beef available to replace our shrinking supplies in cold storage. Although short-run supply boosts from available cold storage and near-record cattle weights should keep beef prices from skyrocketing, high summer demand for beef and improved drought and forage conditions across the country have given farmers and ranchers a reason to retain breeding animals; when this happens, there will be fewer cattle on feed for beef supplies, further supporting higher beef prices. With the discontinuation of NASS’ July cattle inventory survey, the beef industry may have a more difficult time judging the available cattle supplies.

California’s Proposition 12 bans in-state meat sales from animals whose production didn’t meet California’s animal welfare standards, regardless of where they were raised. This is the first year it has been in full effect, and many have anxiously awaited its impact on pork prices. Unsurprisingly, our pork chops rose 8% nationally, up over $1 from last year, to $15.49. Pork chop prices in California were even higher, at $19.91.

Increased broiler production will save your wallet from some of these other protein price increases as 2 pounds of chicken breast will cost you an average of $7.83, a 4% decrease since 2023 and down over 13% from the record high in 2022. Outbreaks of highly pathogenic avian influenza (HPAI) in 2022 sent poultry and egg prices skyrocketing. While the virus still affects some flocks – and now dairy herds – producers have been strengthening biosecurity measures to help poultry flocks recover and stop the spread in dairy. Farmers have increased hatchings and bird weights to mitigate losses and keep prices affordable.

The Fixins

Some say a good cookout is truly made by the sides, but your favorite side dish recipes might see the most drastic price differences from Independence Day 2023.

It’s not just ground beef prices driving the cost of cheeseburgers up. One package of hamburger buns will cost you $2.71, 7% more than 2023. Ending stocks of wheat are at an eight-year low, but increased production should pull wheat and wheat-product prices down as we finish the harvest season. Wheat genetics are notoriously complex and breeding improvements don’t rely on the use of hybrids that seed companies can patent and profit from, most wheat strains and shortages in research to develop new wheat varieties make it a difficult crop to adapt to supply challenges. The U.S. is falling behind other countries in public sector ag research with spending falling by a third from 2002 to 2019. It’s important to prioritize ag research to help keep America a top world provider of agricultural products.

Slow-to-negative milk production growth in recent months has increased the all-milk price, leading the prices for the dairy items up. American cheese slices were relatively stable, only up 1% to $3.57 this year versus $3.53 in 2023. However, a half-gallon of ice cream will add $5.65 to your grocery bill, up 7% from last year.

Lemon production is estimated to fall over 16% this year, due to a citrus greening disease outbreak in California, where most U.S. lemons are produced, in late 2023. In addition to disease effects on citrus trees, regulatory quarantines in the area to mitigate its spread have increased costs to producers. These supply effects have raised lemon prices 13% on average from last year to $3.20 for 1.5 pounds. Sugar prices increased by 11% due to lower global production and increased high-tier tariff imports from Mexico. Made by combining 1.5 pounds of lemons with 1 pound of sugar, fresh-squeezed lemonade had the most drastic price increase on the Fourth of July table at $4.19 total, 12% higher than last year.

The second price decrease in this year’s survey, after chicken, is potato salad, down 4% from last year. The recipe is balancing out higher egg prices with lower potato prices. Two pounds of potatoes will cost an average of $1.53, 17% less than last year, recovering from record-high prices due to weather-related production decreases in recent years. Egg prices are lower than the all-time high in 2022 caused by initial HPAI outbreaks; but egg layer inventories are still under pressure from HPAI, so egg prices are likely to remain above historical averages.

Pork and beans, potato chips, chocolate chip cookies, and strawberries round out our shoppers’ Independence Day tables. Pork and beans are up 2% from 2023 but are still down from 2022. The quantity of chocolate chip cookies our shoppers are asked to price is also down from the record in 2022 but is 2% higher than last year. Strawberries and potato chips are both higher than the last two years. Two pints of strawberries cost $4.61 on average, less than its high in 2021. Labor shortages and wage increases across the supply chain are just one factor increasing food costs, and strawberries are a labor-intensive crop that are likely sensitive to this rising input cost. A large bag of chips costs $4.90 on average, up 8% from last year. Many of our shoppers reported sales on potato chips in their grocery store runs. So, don’t give up hope on summer sales as many retailers place your favorite cookout items on sale to encourage purchases of summertime classics.

Infographic courtesy of the American Farm Bureau Federation.

Coast to Coast

Depending on where you live, your grocery prices may differ from these national averages. In the majority of the country, you will still pay less than $7 per person. Those in the Northeast will feed a hungry crowd of 10 for the low of $63.54. Southerners and Midwesterners will spend an average of $68.33 and $68.26, respectively. Unfortunately for those in the Western U.S., your grocery bill will be nearly $1 per person higher than the national average – $80.88 for a party of 10.

Conclusion

Our volunteer shoppers had their most expensive Fourth of July grocery bill in the history of the survey this year. However, when adjusted for the high inflation rates plaguing the United States in recent years, the real value of their Independence Day party has not surpassed the previous record set in 2022. Though faced with disease outbreaks, inventory shortages and operating challenges, farmers and ranchers have adapted to increased demand across the world for U.S. products, providing safe, affordable food for your Independence Day celebration and every other day, showcasing the resilience of the American food system. Congress must prioritize the passage of a new farm bill that effectively supports farmers in their work to provide sustainable food, fiber and fuel for the globe. So, as you fix your plate this Fourth of July, don’t just thank the cook, thank the farmers and ranchers who work tirelessly to provide the food on your plate.

Inflation is an Issue Across the Supply Chain

The increases in the cost of our cookout items reflect a number of broader economic factors. General inflation has been highly disruptive to the whole economy, leaving behind many whose incomes haven’t kept pace. Rising supply costs and global uncertainties have created new challenges for farmers and everyone in the food supply chain. While food price increases slowed in 2023 after skyrocketing in 2022, the our cookout cost has increased 30% in just five years. Consumers nationwide still view inflation and high food prices as ongoing problems. When adjusted for inflation, our survey total is 5% lower than the previous record year of 2022; but inflation reduces the purchasing power of your dollar over time, making it a problem for consumers and producers alike.

In important ways, Americans still have access to the most affordable food system in the world. The average American spends 6.7% of their total expenditures on food and non-alcoholic beverages, the lowest of any country in the world. Nevertheless, for many, the nutrition programs in the farm bill are critical support.

Despite rising prices in grocery stores, farm finances remain a concern for producers across the U.S. Farm income dropped 17% in 2023 and is expected to decrease another 25% this year. At the same time, production expenses have reached record highs in recent years. Interest rate hikes, which the Federal Reserve uses to rein in inflation, raised farm interest expenditures by 43% from 2022 to 2023. These expenditures are the highest since the 1980s when the U.S. was also plagued by extreme inflation. Farmers and ranchers face high capital costs to operate, and high interest rates not only increase credit costs, but also limit access. Combined with weather uncertainty and volatile commodity prices, farmers and ranchers are vulnerable to significant impacts to their businesses’ bottom line. Higher food prices do not equal higher income for farmers; less than 15 cents of every dollar spent on food goes to the farm once you take into account processing, transportation and marketing.

How the Farm Bill can Help

The farm bill is crucial to providing risk management tools such as crop insurance, marketing or operating loans, and commodity programs. Global challenges have affected consumers and producers alike, and the latest farm bill does not reflect the unique challenges that have developed in recent years. High inflation has made many commodity reference prices too low, undermining the effectiveness of the farm price safety net. Research funding within the bill ensures the industry is advancing innovation that increases productivity, but is tied to fixed dollar amounts. Despite the remarkable effectiveness of our food system, for many the nutrition programs in the farm bill are critical support. The 2018 farm bill has already been extended a year, making our farm programs six years old. That extension expires in September, so it is vital to pass a new farm bill that modernizes these important programs to provide stability for farmers and ranchers while continuing food security for our nation and world.

Comments