JANUARY 16, 2025:

The U.S. Department of the Treasury (Treasury) and Internal Revenue Service (IRS) are releasing additional guidance (Jan. 16, 2025) on the Inflation Reduction Act’s domestic content bonus for Clean Electricity Production and Investment Tax Credits.

The domestic content bonus boosts American manufacturing of iron, steel, and manufactured products used in clean energy projects like solar and wind farms, helping to ensure that American workers and American companies continue to benefit from investments in the clean energy economy. Under the Biden-Harris Administration, companies have announced more than $196 billion in investments in clean power and $92 billion in clean energy manufacturing.

“Ensuring American workers are building the growing clean energy economy is a top priority for the Biden-Harris Administration,” said U.S. Deputy Secretary of the Treasury Wally Adeyemo. “Today’s guidance will help fuel America’s clean energy investment and manufacturing boom and create good-paying jobs.”

The domestic content bonus is one of several tax incentives that are boosting U.S. manufacturing, alongside the advanced manufacturing production credit (45X), the qualifying advanced energy project credit (48C), and the CHIPS advanced manufacturing investment credit (48D), as well as incentives to produce clean energy that are increasing demand for components.

The guidance Treasury released today updates and builds upon the domestic content safe harbor that Treasury and the IRS published in May of 2024 that provides clean energy developers the option to rely on default cost percentages provided by Department of Energy (in lieu of obtaining direct cost information from suppliers) to determine eligibility for the domestic content bonus. Today’s guidance reflects improved default values that more closely align with the characteristics and costs of applicable project components and manufactured product components in the marketplace, as analyzed by the Department of Energy.

The guidance establishes optional alternative cost percentages for developers of solar projects that use solar cells manufactured with domestically-produced wafers to appropriately recognize cost differentials for manufacturers who use cells made with domestic wafers, thereby enhancing incentives for onshoring wafer manufacturing.

The guidance also provides a variety of updates to clarify use of the safe harbor tables, including:

- Solar: The updated tables update cost percentages, make certain adjustments to the characterizations of applicable project components and manufactured product components, and offer clarifying definitions.

- Domestic Solar Wafers: For each solar table, there are new optional alternative cost percentages for projects using domestic solar cells manufactured with domestic wafers.

- Land-Based Wind: The updated table for Land-Based Wind includes minor adjustments to the characterizations of applicable project components and manufactured product components.

- Battery Electric Storage System (BESS): The updated table updates cost percentages, makes certain adjustments to the characterizations of applicable project components and manufactured product components, and offers clarifying definitions.

In addition, the guidance provides additional clarity on the use of the tables for retrofits, projects utilizing elective pay (also known as direct pay), as well as carport and floating solar projects. Taxpayers may utilize the safe harbor tables included in this guidance for projects beginning construction up to 90 days after the release of further guidance.

JANUARY 15, 2025:

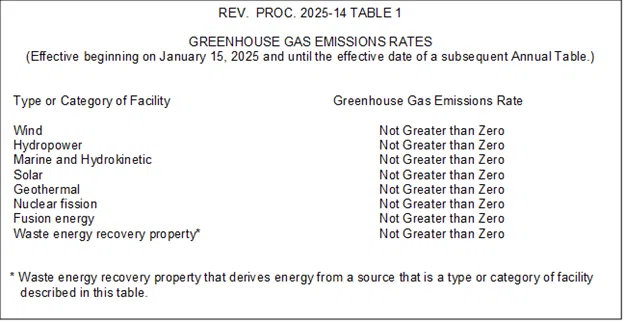

The U.S. Department of the Treasury released (Jan. 15, 2025) the first Annual Table that provides greenhouse gas emissions rates for certain types or categories of facilities that are eligible for the Clean Electricity Production and Investment Tax Credits – also known as the technology-neutral credits – in tax code sections 45Y and 48E.

The Clean Electricity Credits encourage innovation by allowing new technologies that develop over time to become eligible for the tax credits. The Annual Table released provides important confirmation that certain clean electricity facilities qualify categorically for the credits – including geothermal, nuclear fission, nuclear fusion, wind, solar, hydropower, marine and hydrokinetic, and certain waste energy recovery property facilities – consistent with the final rules released earlier this month.

Infographic courtesy of the United States Department of the Treasury.

Taxpayers with types or categories of facilities that are not described in the Annual Table will be able to request a Provisional Emissions Rate (PER) for those facilities. Those PER requests will be evaluated by the National Labs consistent with the final rules. For example, a combustion and gasification facility would require a lifecycle emissions analysis consistent with the statute and the final rules, whereas a non-combustion and gasification facility (such as a fuel cell that exclusively utilizes electrolytic hydrogen) would require a technical and engineering assessment of the fundamental energy transformation into electricity and would not have to undergo a full lifecycle emissions analysis. The National Labs are already working on such an assessment for fuel cells utilizing electrolytic hydrogen, which the Department of Energy expects will be complete in the coming weeks. This assessment will accelerate the PER request process for such fuel cells.

DECEMBER 5, 2024:

The U.S. Department of the Treasury and the IRS have released (Dec. 4, 2024) final rules for the Section 48 Energy Credit – also known as the Investment Tax Credit (ITC) – that will give clean energy project developers clarity and certainty to undertake major investments to produce more clean power and further strengthen America’s clean energy economy.

For decades, the ITC has fueled U.S. clean energy development by providing a tax credit for investments in qualifying clean energy property – generally 30% of the cost of the project, although the level of the credit has varied over time and by technology.

While the ITC has advanced clean energy projects, its effectiveness was limited by the need for recurring short-term and retroactive legislative extensions, creating uncertainty and making it harder for clean energy developers to make investments and secure financing for projects.

The Inflation Reduction Act extended the ITC – as well as the closely related Production Tax Credit (PTC) – until 2025, at which point the ITC and PTC will switch to a tech-neutral approach with credits that will be available in full for projects beginning construction at least through 2033.

“By ending short-term legislative extensions for the Investment Tax Credit, the Inflation Reduction Act has given clean energy project developers clarity and certainty to undertake major investments and produce new clean power to meet growing electricity demand,” said U.S. Deputy Secretary of the Treasury Wally Adeyemo. “Today’s announcement will help lower consumers’ utility bills, strengthen U.S. energy security, and create good-paying jobs.”

Although the final rules retain the core framework of the proposed rules and guidance Treasury and the IRS issued in November 2023, the final rules clarify general rules for the ITC and its definitions of property eligible for the credit, informed by 350 written comments from stakeholders. Specific issues raised by commenters that the final rules address include:

- Offshore wind: The final rules retain the clarification made in the proposed rules that owners of offshore wind farms can claim the credit for power conditioning and transfer equipment (e.g., subsea cables) that they own.

- Geothermal heat pumps: The final rules clarify that the owner of underground coils can claim the ITC if they own at least one heat pump used in conjunction with the coils.

- Biogas: The final rules clarify what property is qualified biogas property and what is an integral part of qualified biogas property.

- Definition of “energy project”: The final rules revise the definition of energy project to require ownership of the energy properties plus four or more factors from a list of seven factors and clarify that taxpayers can assess the factors at any point during construction or during the taxable year energy properties are placed in service.

- Co-located energy storage: The final rules clarify that a section 48 credit may be claimed for energy storage technology that is co-located with and shares power conditioning equipment with a qualified facility for which a section 45 credit is claimed.

- Hydrogen storage: The final rules clarify that hydrogen energy storage property does not need to store hydrogen that is solely used as energy and not for other purposes.

Comments