July 7, 2025:

The U.S. House passed the U.S. Senate’s version of the federal budget reconciliation and tax cuts bill July 3, 2025. President Donald Trump signed his “One Big Beautiful Bill” into law on July 4. The federal spending bill includes many provisions important to agriculture. Reactions from agriculture groups are below.

National Cattlemen’s Beef Association:

Following President Donald J. Trump’s signing of the One Big Beautiful Bill into law, the National Cattlemen’s Beef Association (NCBA) highlighted key provisions in the bill that deliver wins for America’s family farmers and ranchers.

“Since day one, NCBA has been working with Congress to make sure the One Big Beautiful Bill includes policy priorities for America’s hardworking family farmers and ranchers,” said NCBA President Buck Wehrbein, a Nebraska cattleman. “I’m proud that this legislation protects farms and ranches from being split up and sold off to pay a high Death Tax bill. I’m also glad the One Big Beautiful Bill protects pro-business tax deductions for cattle producers, lowers our taxes overall, and funds programs like the Livestock Forage Disaster Program, Livestock Indemnity Program, voluntary conservation programs, and invests in keeping foreign animal diseases out of the United States.”

All of NCBA’s tax priorities are included in the One Big Beautiful Bill along with numerous Farm Bill provisions.

Tax Provisions for American Cattle Producers

Death Tax: The bill increases the Death Tax exemption to $15 million per individual or $30 million per couple, adjusted annually for inflation. This means if the value of your farm or ranch plus equipment, cattle, and other assets are less than $15 million individually or $30 million as a couple, you will pay no Death Tax. The Death Tax has forced many farmers and ranchers to sell off land, equipment, or cattle to pay the high tax. NCBA supports fully eliminating the Death Tax, but until then, this increased threshold is a huge victory for protecting more family farms and ranches than ever before.

Section 199A: The Section 199A Small Business tax deduction is made permanent at 20% by this bill. Section 199A allows small businesses, like family farms and ranches, to deduct 20% of their business income, helping them save more of their hard-earned money.

Section 179: Section 179 allows small businesses to deduct the cost of equipment. Thanks to the One Big Beautiful Bill, farmers and ranchers will now be able to deduct up to $2.5 million in qualified equipment expenses. The phaseout threshold for this deduction is increased to $4 million and these limits will be adjusted annually for inflation.

Bonus Depreciation: Bonus depreciation allows small business owners to deduct the cost of equipment upfront, rather than deduct depreciation over several years. Under this bill, 100% bonus depreciation is made permanent.

Disaster-Related Casualty Loss: The Big Beautiful Bill permanently extends itemized deductions for personal casualty losses resulting from federally declared disasters. This is an extension of the Federal Disaster Tax Relief Act that was previously supported by NCBA and enacted in December 2024.

Farm Bill Provisions for American Cattle Producers

Livestock Forage Disaster Program: The Big Beautiful Bill increases to two monthly payments for the Livestock Forage Disaster Program and expands the program by allowing it to kick in after 4 consecutive weeks of drought, rather than the previous 8 consecutive weeks.

Livestock Indemnity Program: The bill funds indemnity payments at 100% of the market value for livestock losses due to predation and 75% of market value for losses due to adverse weather. Additionally, there will be payments made for the loss of unborn livestock.

Voluntary Conservation Programs: The Big Beautiful Bill funds several voluntary conservation programs for six years, including:

- $18.5 billion for the Environmental Quality Incentives Program.

- $8.1 billion for the Conservation Stewardship Program.

- $4.1 billion for the Agricultural Conservation Easement Program.

- $2.7 billion for the Regional Conservation Partnership Program.

Animal Disease Prevention: The bill increases annual funding for animal disease prevention and cattle health to $233 million per year. This funding goes towards the “three-legged stool” programs that NCBA supports, including:

- $153 million per year for the National Animal Vaccine and Veterinary Countermeasures Bank (NAVVCB), which houses the foot-and-mouth disease vaccine and test kits.

- $70 million for the National Animal Health Laboratory Network (NAHLN).

- $10 million per year for the National Animal Disease Preparedness and Response Program (NADPRP).

Additionally, the One Big Beautiful Bill does not include controversial provisions to sell public lands or expand eminent domain.

“NCBA thanks our state affiliates and congressional leaders for passing this legislation and we thank President Trump for signing it into law, showing he is a true friend to America’s cattlemen and cattlewomen,” Wehrbein added.

National Sorghum Producers:

National Sorghum Producers today applauded final congressional passage of the “One Big Beautiful Bill,” a sweeping reconciliation package that includes major policy victories for sorghum farmers. The bill passed the House of Representatives Thursday in a narrow 218–214 vote following earlier Senate approval. President Donald Trump is expected to sign the legislation on Independence Day.

The bill delivers significant gains for sorghum growers, including:

- Increased reference prices under Title I of the Farm Bill

- Improvements to PLC and ARC programs to strengthen the commodity safety net

- Crop insurance improvements to enhance producer risk management

- Expanded trade development funding to grow export markets

- Extension of the 45Z clean fuel production credit benefiting biofuel-related sorghum demand

- Permanent extension of key tax provisions important to farmers and rural businesses

“This is a strong step forward for producers who have waited too long for the certainty they need to plan ahead,” said NSP Chair Amy France, a farmer from Scott City, Kan. “We thank House Agriculture Chairman Glenn ‘GT’ Thompson and Senate Agriculture Committee Chairman John Boozman for their leadership in making sure farmers were at the center of this effort.”

“On behalf of sorghum producers nationwide, we’re grateful to congressional leaders and the administration for making agriculture a top priority,” NSP CEO Tim Lust said.

National Pork Producers Council:

- Preserving necessary resources to protect the nation’s food supply through foreign animal disease (FAD) prevention, including:

o National Animal Disease Preparedness and Response Program

o National Veterinary Stockpile

- Maintaining market access programs for U.S. pork.

o Also, $285 million for a new “Supplemental Agricultural Trade Promotion Program” will support critical market access.

- Maintaining resources for the feral swine eradication program to protect the health of our herds.

- Making the Qualified Business Income Deduction permanent, allowing producers to make organizational decisions for their businesses not based solely on tax liability.

- Making Bonus Depreciation permanent at 100% to provide producers with flexibility to plan cash flows for major asset acquisitions.

- Changing the way the Business Interest Expense Limitation is calculated to avoid harming producers who rely on borrowing to make improvements or normalize cash flow in poor market conditions.

- Increasing the Estate Tax Exemption and making it permanent to prevent new tax exposure for family-owned farms.

- Substantially increasing the expensing limitations of Section 179 to provide producers flexibility in planning cash flows around major asset acquisitions.

American Coalition for Ethanol:

“We’re grateful to our Congressional champions for their steadfast leadership to support and strengthen the 45Z credit, which is remarkable considering the fact most other IRA-era tax credits were limited or phased-out in the final package. While there were other improvements we had hoped to achieve in the final 45Z language, restoring transferability of the credit, removing indirect land use change (ILUC) penalties, and restricting feedstock eligibility to USMCA countries will strengthen the credit from its original version.”

“In terms of the credit term, we preferred the House language which would have extended 45Z through 2031, and we also urged Congress to specifically allow low-carbon farming practices to be monetized through 45Z with the feedstock calculator and guidelines USDA has released, but nevertheless ACE remains committed to working with federal agencies to implement the credit in ways that reward on-farm conservation practices and accelerate the use of homegrown, low-carbon biofuels.”

ACE has been working to help monetize low-carbon farming practices in 45Z through their 10-State USDA Regional Conservation Partnership Program (RCPP). Once farmers participating in the project have implemented reduced-till, 4R nutrient management, or cover crops, land-grant university scientists will collect soil samples and other field-level data about the resulting carbon benefits to better calibrate the GREET model and the USDA FDCIC to generate more reliable carbon scores for farming practices. Running the data through these models solves for ‘information gaps’ which currently prevent farmers and ethanol producers from monetizing ag practices in 45Z and through regulated fuel markets.

The ACE RCPP is the key to unlock 45Z to allow ethanol producers to generate and benefit from low-carbon farming practices.

The 45Z credit, originally enacted under the Inflation Reduction Act, provides technology-neutral incentives for clean fuels based on lifecycle greenhouse gas emissions. The final version extends the 45Z credit through the end of 2029—two years beyond its current expiration date of Dec. 31, 2027. It also limits eligibility to fuels made from feedstocks produced or grown in the U.S., Mexico, or Canada, and revises how lifecycle GHG emissions are calculated by excluding emissions from indirect land use change (ILUC).

Poet:

With H.R. 1 signed into law, POET, the world’s largest producer of biofuels, thanked President Donald Trump today for securing an extension of 45Z clean fuel production incentives.

“President Trump continues to reassert his support for American farmers and energy independence,” said Joshua Shields, POET’s Senior Vice President of Corporate Affairs. “With this extension signed into law, 45Z is now best positioned to transform U.S. agriculture, providing new markets for farmers and furthering biofuel energy dominance. POET thanks both President Trump and our biofuel champions in Congress for their hard-fought efforts to get this provision across the finish line.”

National Council of Farmer Cooperatives:

The National Council of Farmer Cooperatives (NCFC) praised the final passage of the budget reconciliation bill by Congress, highlighting the permanent extension of Section 199A as a major victory for America’s farmers and cooperatives.

“With this bill now headed to the president’s desk, Congress has taken decisive action to prevent a massive tax increase on agriculture—an increase that would have exceeded more than $2 billion had Section 199A been allowed to expire,” said Chuck Conner, President and CEO of NCFC. “Making Section 199A permanent ensures that farmer-owned cooperatives and the producers who rely on them are treated fairly in the tax code.”

“This is a vital step forward in safeguarding the cooperative model—a model that keeps more value in rural communities, strengthens the family farm, and supports a resilient agricultural economy,” Conner said. “Congress has demonstrated that it understands what’s at stake for rural America.”

NCFC also recognized Congress for extending other key tax provisions in the bill, including Section 179 expensing and the clean fuel production credit under Section 45Z. These measures provide co-ops and producers with long-term incentives to invest in innovation, infrastructure, and sustainability.

“As we await the president’s signature, we urge the administration to move quickly to enact this important legislation,” said Conner. “America’s farmers and co-ops need the certainty and support this bill delivers.”

July 2, 2025:

The Senate passed (July 1, 2025) by a slim margin—with Vice President J.D. Vance casting the tiebreak—its version of the “One Big Beautiful Bill.” It includes many provisions important to agriculture. Reactions from agriculture groups are below.

American Soybean Association:

“ASA applauds the Senate for its support of agriculture and the farm economy in this legislation. Soybean growers have long championed comprehensive revisions to the 45Z Clean Fuel Production Credit, an improved safety net for agriculture, and increased support for research and market expansion,” said ASA President Caleb Ragland, a Kentucky soybean grower. “The modified biofuel tax credits, enhancements to crop insurance and support for MAP and FMD, among other agriculture provisions included in this legislation will support U.S. farmers and expand market opportunities domestically. ASA urges the House to maintain these key agricultural provisions that support our rural economies as they consider this legislation.”

American Farm Bureau Federation:

The Senate provided support for farmers and ranchers nationwide by passing their version of the “One Big Beautiful Bill Act (OBBBA).” Some details of the House bill were altered to ensure compliance with the Byrd Rule, which requires that all provisions of a reconciliation bill impact the government’s budget – through changing revenues or spending. This rule is enforced by the Senate parliamentarian who determines if any part of the bill is non-Byrd Rule compliant, which would require 60 –votes to pass.

The final Senate bill provides additional investments in agricultural support programs and additional certainty for farmers’ and ranchers’ tax bills.

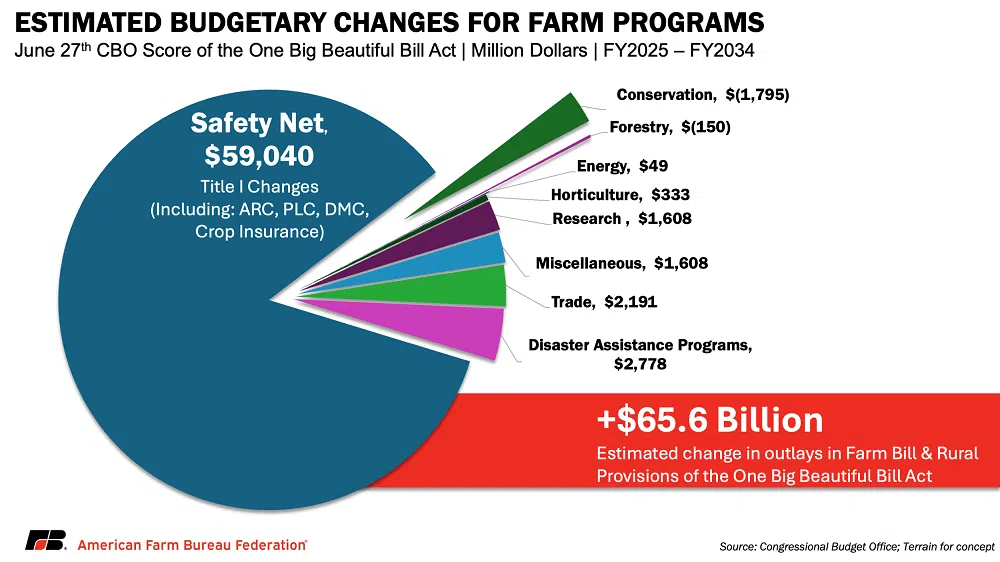

Courtesy infographic.

Both the House and Senate budget reconciliation packages aim to strengthen the farm safety net by updating key commodity risk management programs. Both versions continue Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) payments, and increase reference prices and commodity loan rates. These updates better reflect today’s higher production costs and market conditions. Overall, the Senate version invests over $65.6 billion into the farm safety net, $9 billion more than in the House version.

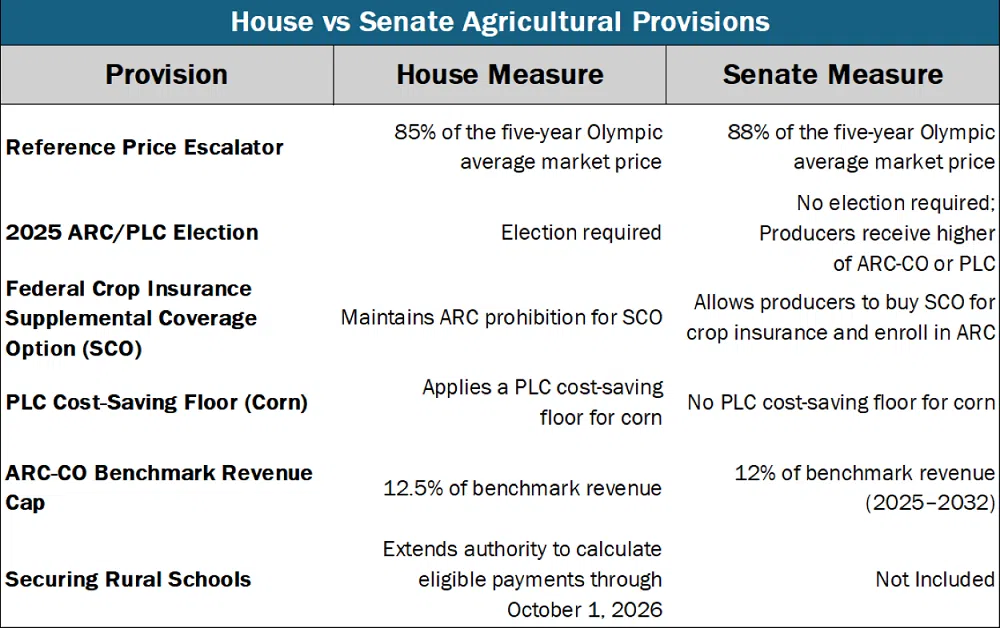

In addition, there are a few key differences between the House and Senate text. First, while the Senate keeps the updated reference prices from the House version, the Senate text increases the PLC reference price escalator calculation to 88% compared to the current 85%. Remember, this is the provision included in the 2018 Farm Bill that can adjust the effective reference price based on past market prices. The Senate also addresses the current crop year already in progress and allows producers to automatically receive the higher of the ARC-CO or PLC payment without having to make an election for the 2025 crop year. Additionally, the Senate does not move forward a House plan for a PLC cost-saving floor for corn that would limit support when market prices are high. Both versions improve ARC-CO by increasing the benchmark revenue cap, though the Senate increased the cap to 12%, while the House set it at 12.5% for crop years 2025 through 2032.

The Senate version updates the Federal Crop Insurance program to allow farmers to purchase the Supplemental Coverage Option (SCO) while enrolled in ARC. Historically, SCO was only available to those enrolled in PLC, limiting coverage options. Expanding access to both ARC and SCO will give farmers more flexibility and strengthen their risk management tools.

Secure Rural Schools was not included in this version of the OBBBA because the Senate had already chosen to reauthorize the program as a stand-alone bill. The Senate passed the Secure Rural Schools Authorization Act of 2025 in June. A companion standalone bill has been introduced in the House of Representatives, but it has not yet been taken up for a vote.

Courtesy infographic.

National Cattlemen’s Beef Association:

“The Senate version of the One Big Beautiful Bill protects family farmers and ranchers across the country from a massive tax hike at the end of the year, increases the Death Tax exemption, makes the Section 199A tax deduction permanent, increases the Section 179 tax deduction, funds foreign animal disease prevention programs, and delivers so many more wins for cattle producers.

“The Senate version of the bill also does not include controversial provisions that have gained national attention. The bill does not include any sale of public lands, and it does not include controversial language on eminent domain. NCBA’s grassroots policy supports landowners’ private property rights, and we oppose the expanded use of eminent domain.

“It’s time for the House to pass this bill and send it to President Trump’s desk so he can sign it into law.”

- $10 million per year for the National Animal Health Laboratory Network (NAHLN)

- $70 million per year for the National Animal Disease Preparedness and Response Program (NADPRP)

- $153 million per year for the National Animal Vaccine and Veterinary Countermeasures Bank (NAVVCB)

National Sorghum Producers applauds the U.S. Senate’s passage of its reconciliation package, which includes several important provisions that will strengthen the farm safety net and deliver meaningful benefits for sorghum growers. The legislation, passed by a 51-50 vote, now returns to the House for further consideration ahead of the president’s July 4 deadline.

The package includes a $50 billion increase for the Price Loss Coverage (PLC) program, reduced crop insurance premiums, and new investments in trade promotion, agricultural research, disaster assistance and tax policy certainty for family farms.

The legislation also extends the Section 45Z clean fuel production credit through 2029 and maintains strong language on domestic feedstock eligibility supported by U.S. farm groups. NSP supports the long-term stability this credit provides and will continue to advocate for biofuels policy that recognizes the value of sorghum in the energy economy.

“These are critical improvements that will help sorghum producers manage risk, plan for the future, and stay competitive,” said NSP Chair Amy France, a farmer from Scott City, Kan. “We’re grateful to Chairman Boozman and other leaders in the Senate Ag Committee who ensured these priorities were part of the final bill.”

NSP will continue working with lawmakers in both chambers to ensure the strongest possible outcome for sorghum producers as the bill advances.

Following Senate passage of the One Big Beautiful Bill Act, Corn Refiners Association President and CEO John Bode released a statement welcoming progress to support the nation’s farmers and ranchers and calling for bipartisan work to secure stability for the USDA BioPreferred Program.

“The reconciliation package under consideration on Capitol Hill includes important language to ensure the continuity of the farm safety net and prevent a substantial tax increase, and we are pleased to see the process continue to unfold,” said Bode. “As lawmakers continue their work on this package and other legislation in 2025, CRA stands ready to aid efforts to include an extension of USDA’s BioPreferred Program in a piece of legislation destined for President Trump’s desk. This critical program supports farmers, rural communities, and domestic manufacturing jobs, and its continued success would be a tremendous benefit to the American economy.”

Plant Based Products Council:

The Plant Based Products Council, which represents companies and stakeholders at the forefront of innovation in the ag bioeconomy, released a statement expressing disappointment about the BioPreferred Program being removed from the One Big Beautiful Bill Act.

“While we appreciate Congress’s continued support for agricultural producers, we’re deeply concerned about the uncertainty facing USDA’s BioPreferred Program,” said James Glueck, Executive Director of the Plant Based Products Council. “For more than two decades, this bipartisan program has successfully driven American manufacturing job creation while strengthening markets for farm commodities. At a time when rural communities need economic opportunity and America needs supply chain resilience, we cannot afford to let this proven program languish. We urge congressional leaders to act swiftly on reauthorization and modernization that will unlock the full potential of our bioeconomy.”

Comments