Several factors can weigh down farmland values, said Tim Koch, Farm Credit Services of America Executive Vice President – Business Development. “My crystal ball is not very clear,” Koch told American Farmland Owner from his office in Omaha, Nebraska. “But I’d anticipate more downward pressure on values than upward for the rest of the year.”

Koch has spent most of the past three decades ascending through Farm Credit Services of America’s leadership structure.

Farm Credit Service of America Land Value Survey Finds Financial Pressures

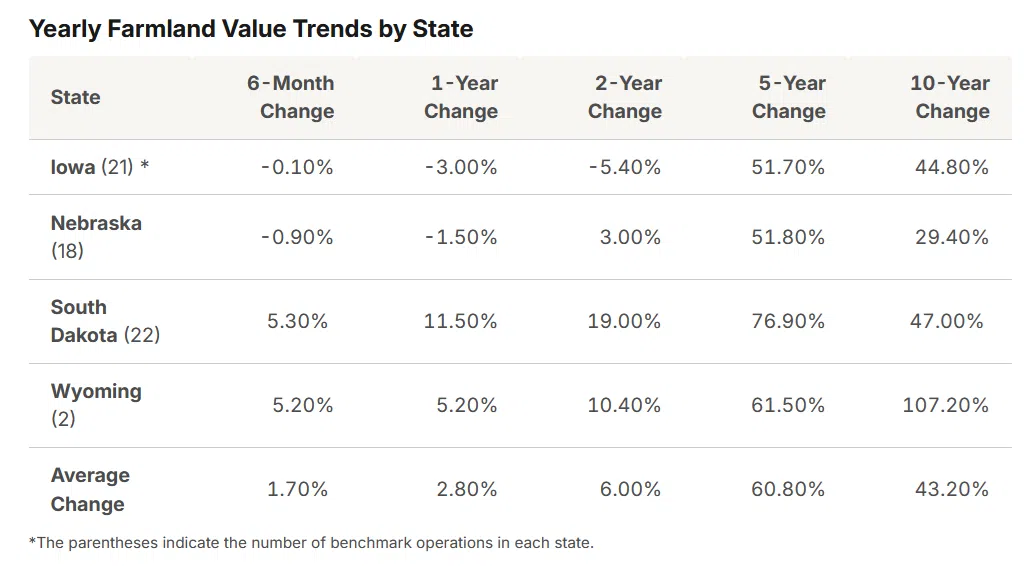

Koch, who had once planned to become an accountant, instead now spends his days pouring over figures from his company in a different way. Farm Credit Services of America’s latest Land Values Report showed that values climbed – albeit slightly – in the eight states that it surveyed during the six months of 2025.

Farm Credit Service of America Land Values Report for the first half of 2025 surveyed these states:

-

Iowa

-

Kansas

-

Minnesota

-

Nebraska

-

North Dakota

-

South Dakota

-

Wisconsin

-

Wyoming

Farm Credit Services of America looks at designated benchmark farms from across the eight-state region to follow trends in farmland values. The report found an average gain of 1.10%.

Tim Koch: Local Factors Impact Farmland Values

Tim Koch: Local Factors Impact Farmland Values

“It’s probably much more local than it is geographically dispersed. Real estate is a very local market,” Koch said.

He emphasized that land sales are largely driven by nearby producers, many of whom are bound by geography and local demand dynamics.

In other words, don’t expect Iowa’s land market to move in lockstep with Minnesota’s. “I don’t know that I would draw a conclusion that the prices in Iowa are necessarily linked more closely to Minnesota or South Dakota,” Koch said. “It all comes down to who’s buying, why they’re buying, and when.”

When asked about the role of interest rates—a constant concern in today’s financial climate—Koch offered a nuanced take.

Interest Rates Likely Don’t Have Major Influence of Farmland Values

“A reduction in interest rates is really a reduction in the overall cost,” he said. “But it’s important to understand they’re talking about short-term interest rates. That doesn’t necessarily mean that the interest rate we’re paying on farmland loans is going to come down.”

Koch explained that the yield curve remains relatively flat, which limits the impact of short-term rate changes on long-term borrowing costs. While the Federal Reserve may begin signaling cuts as soon as September, Koch cautions that the actual impact on farmland loan rates may be limited in the near term.

Looking ahead to the rest of 2025, Koch sees a mixed bag of influences. “If I had to speculate,” he noted, “I would say we’ll probably see more downward pressure on real estate values.”

Farmers Not As Optimistic About the Short-Term Future

His reasoning is grounded in shifting commodity prices and waning producer sentiment. “Most of these purchases were influenced at a time when corn and soybean prices were probably 50 cents to a dollar higher than they are today. The producer sentiment was better three or four months ago than it is today,” Koch explained.

With corn prices softening and recent support from programs like disaster relief payments ending, some farmers are beginning to tighten finances even more. Koch predicts, “You’re more likely to see people stay on the sidelines, hold on to the available cash that they have, until they see maybe a little more certainty about what this commodity price cycle is going to look like.”

Comments