New data released Sept. 6, 2025, by Farmers for Free Trade reveals current trends impacting South Dakota agriculture trade including top markets, export performance and the impact of tariffs on exports and ag inputs. The report comes at a key moment for South Dakota, the country’s 20th largest agricultural exporting state. The comprehensive analysis highlights both opportunities and challenges facing South Dakota farmers as agricultural trade policies continue to evolve.

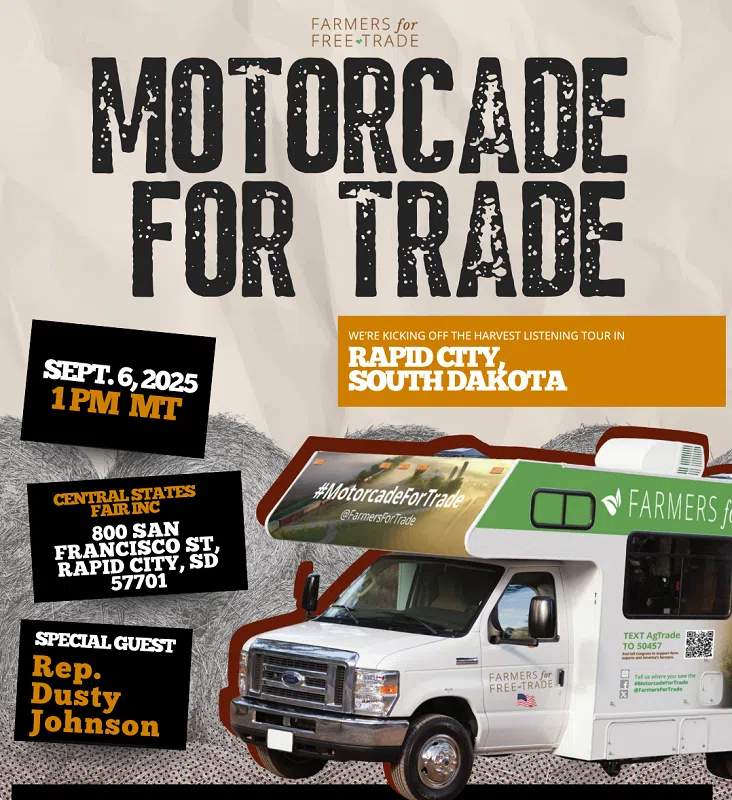

The data release comes ahead of Saturday’s Motorcade for Trade event at Central States Fair in Rapid City, where Rep. Dusty Johnson (R-SD), Co-Chair of the Congressional Ag Trade Caucus and member of the House Agriculture Committee, will join agricultural leaders to discuss trade policy impacts on South Dakota’s farm economy.

Major Export Markets Drive South Dakota Agriculture

South Dakota farmers depend on export markets for nearly a third of their agricultural production, with agricultural exports making up about 30 percent of their earnings. Soybeans, corn, and wheat and meslin remain entrenched as the state’s top agricultural exports, accounting for nearly half of total exports.

The data reveals South Dakota’s top four export markets and their significance to the state’s agricultural economy:

Canada leads at $949 million (25% of total goods exports), serving as the top export market for ethanol and soybean oilcake, with 95% of exports going to Canada. Canada is also a major export destination for South Dakota pork.

China follows at $844 million (22% of total goods exports), representing the top export destination for soybeans, with nearly 60% of South Dakota soybeans going to China. China is also the top export destination for edible offal.

Mexico accounts for $543 million (14% of total goods exports), serving as a major export market for corn and soybeans, with 23% and 9% going to Mexico respectively. Mexico is also the top market for South Dakota pork and beef.

Japan rounds out the top four at $276 million (7% of total goods exports), representing the top export market for South Dakota corn, with over 25% of exports going to Japan. Japan is also an important market for exports of pork and soybeans.

Mixed Results for Key Commodities in 2025

Analysis of the first half of 2025 compared to 2024 reveals significant trends among South Dakota’s key farm exports:

Corn exports surged nearly 50%, driven by rising exports to Korea, Japan, and Colombia, despite exports to China virtually stopping.

Soybean exports declined more than 10%, attributable to a 50% decline in exports to China and a 47% decline in exports to Indonesia. Notably, there were no soybean exports to China in June 2025.

Pork exports dropped over 20%, driven by a 50% decline in exports to Mexico and a 20% decline in exports to Canada.

Wheat and meslin exports increased 4%, with growth to smaller export markets like Nigeria and Ecuador helping offset a 50% decrease in exports to Mexico and 100% decrease in exports to China.

“As the China examples show, risks to South Dakota farmers could grow if more countries choose to retaliate against U.S. exports in the future,” the analysis notes.

Tariffs Increase Input Costs for South Dakota Farmers

The data also reveals how current tariffs are raising costs for essential farm inputs in the first six months of 2025:

Farm Machinery & Equipment: $1.4 million in extra tariffs paid on imports into South Dakota due to Section 301, IEEPA, or other executive authority tariffs

Steel & Building Materials: $14 million in extra tariffs paid on products subject to steel and aluminum 232 tariffs

Vehicle & Transportation Costs: $5.2 million in extra tariffs paid on products on the autos and auto parts section 232 list

Current tariffs are raising the cost of inputs farmers rely on, including machinery, fertilizer, and other essential farm equipment. Additional tariffs on steel and aluminum could increase the cost of farm machinery, equipment, and building materials, while additional tariffs on automobiles and parts could increase the costs of vehicles.

The Rapid City event is part of Farmers for Free Trade’s 14-state “Motorcade for Trade” campaign, a 2,500-mile tour across America’s agricultural heartland designed to amplify farmer voices calling for open markets and reduced trade barriers. The campaign will conclude with a major event in Washington, D.C. in early November.

About Farmers for Free Trade: Farmers for Free Trade represents agricultural producers who support open markets and reduced trade barriers. The organization advocates for policies that expand market access for American agriculture.

About Trade Partnership Worldwide: Trade Partnership Worldwide, LLC is an international trade and economic research firm based in Washington, D.C. that is a recognized leader in trade information and statistics and is regularly cited in all major news outlets.

Comments