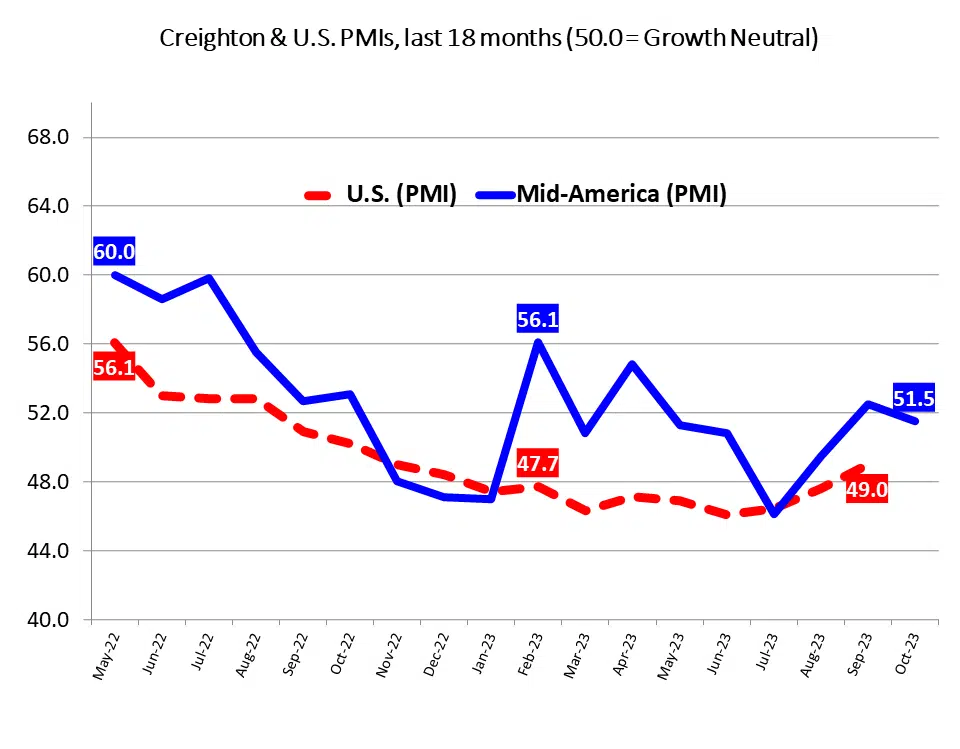

In his monthly (Nov. 1, 2023) Mid-America Business Conditions Index survey of supply managers in the nine Mid-America states from the Dakotas to Arkansas, Creighton University Economics Professor Dr. Ernie Goss says the manufacturing economy is limping along….but in a positive direction.

“This is the second straight month it has been above growth neutral. Sixty percent of the manufacturing supply managers expect a downturn in economic activity over the next six months. Only one in 10 sees growth ahead – that’s not exactly what we’re looking for, but it’s still above growth neutral for the month.”

Goss says supply managers reported concern about inflation, supply chain disruptions, labor shortages, job losses and higher interest rates. Hiring fell below growth neutral in October 2023 with the Mid-America region still falling behind the national economy. Meanwhile, he says, job wages have increased this past year.

“I calculated wage growth over the last year, and wages expanded by 3.4%. Unfortunately, that’s about the rate of inflation over the last 12 months. All in all, the labor market is showing some stress right now. It’s not as much as you might have expected several months ago.”

Meanwhile, inflation is still above growth neutral but is coming down. October marked its lowest inflation reading since last December.

“One thing we asked supply managers about is to forecast how much they think prices for the products they purchase will grow by over the next six months. They reported a 4.2%, on average, increase over the next six months. Of course, you double that for the year, and you get 8.4%. That’s well above inflation and a concern going forward.”

While no interest rate hike is expected in November, Goss anticipates a rate hike of 0.25% in December.

“Inflationary pressures are coming down though, and that’s good news. The problem is, it’s getting to the sticky part. In other words, the difficult work is ahead. The Fed is trying to get down to 2% on the inflation front, and that’s going to take some more effort and rate hikes, in my judgement. There’s too much federal spending out there. There’s too much money that has previously been spent and too much money that is going to be spent. That is going to put some pressure on the Federal Reserve to keep interest rates high or increase interest rates.”

In the months ahead, Goss anticipates a slow down or rolling recession that will impact parts of the economy, such as banking, manufacturing and real estate.

In South Dakota specifically, Goss says the October Business Conditions Index soared to 59.0, a regional high, from 49.8 in September. Components of the overall index were: new orders at 51.3; production or sales at 50.4; delivery lead time at 64.8; inventories at 62.9; and employment at 65.6. Over the past 12 months, according to U.S. Bureau of Statistics data, the state’s manufacturing sector boosted employment by 1.4% with the average hourly wage rate expanding by 9.0% for the period, or more than twice the 3.7% increase in consumer prices.

Comments