Every autumn, pumpkins take center stage in America, adorning porches as jack-o’-lanterns, starring in pies and lattes and fueling a seasonal economy. What began as an old Irish tale of “Jack of the Lantern” (originally carved from turnips) has grown into a multi-million-dollar U.S. industry. Native to North America, pumpkins are truly an all-American crop, one of the continent’s oldest cultivated plants and a symbol of fall. In 2021, Americans spent over $10 billion on Halloween festivities, and nearly 94 million people planned to carve pumpkins, a testament to the cultural and economic weight of this (typically) bright orange crop. This Market Intel explores U.S. pumpkin production and a few of the challenges their dedicated farmers face.

Pumpkin Production and Use Dynamics

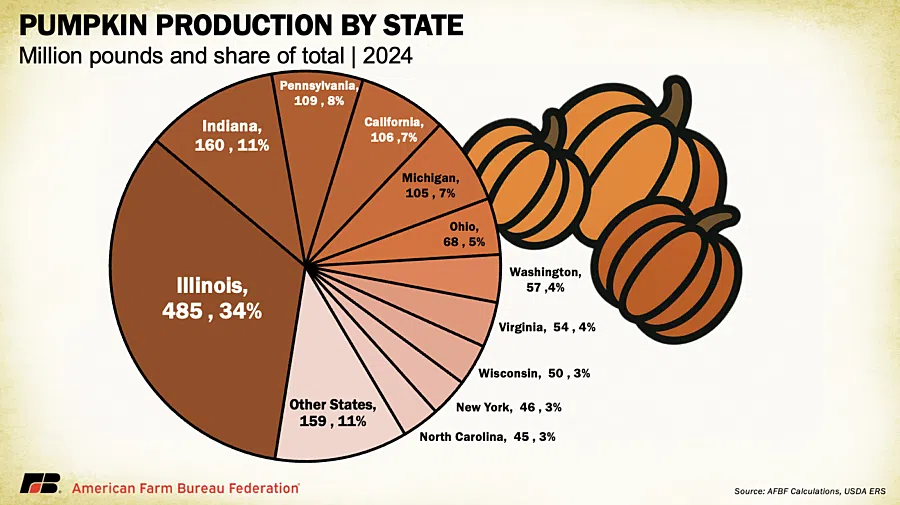

Pumpkins are grown across the country on more than 68,000 acres, producing roughly 1.4 billion pounds in 2024. A handful of states dominate: Illinois, Indiana, Pennsylvania, California and Michigan together account for about 66% of all pumpkin output. Illinois alone harvested about 15,400 acres and produced 485 million pounds, more than the other four top states combined.

Illinois’ edge lies in processing pumpkins with 90% of its crop going to pie filling and canned products. Libby’s, the major canned pumpkin processor, sources nearly all its pumpkins from Illinois. Elsewhere, growers focus on fresh ornamental pumpkins for carving or decoration. The U.S. now grows an eclectic mix, from classic Howden jack-o’-lanterns to white “ghost” pumpkins and warty heirlooms, as consumers crave distinctive fall displays. Yields vary widely with Illinois’ processing fields averaging 31,500 pounds per acre in 2024, while states like Pennsylvania averaged about 16,000 pounds per acre.

In total, U.S. pumpkin farmers produced over $274 million in value in 2024. Illinois led in volume but earned just $21 million because of lower processing prices, compared with $40 million in Indiana, $32 million in Pennsylvania, and $28 million in Washington. Prices range dramatically, from Illinois’s $50 per 1,000 pounds (about 5 cents per pound) for processing pumpkins to Washington’s $324 per 1,000 pounds (about 32 cents per pound) for fresh pumpkins. Retail prices reflect the same trend. In October 2024, a large carving pumpkin averaged $6.21, wholesale bins sold around $157 for carving pumpkins and $212 for smaller pie pumpkins, while rare heirloom varieties reached $350 per bin.

On the international front, the U.S. exported $26.3 million in pumpkins in 2024, mainly to Canada ($21.8 million) and Mexico ($3.3 million), and imported $21.7 million, primarily from Canada, Costa Rica and Panama. In 2024, the U.S. also exported $3.8 million in pumpkin seeds with $2.2 million going to Canada, $410,000 to Germany and $314,000 to the United Kingdom.

Pumpkins are planted in late spring and harvested just before fall, with roughly 80% of production and use occurring during autumn holidays. Per-capita consumption/use has climbed to 5–6 pounds per year, up from 4 pounds in the early 2000s.

Comments