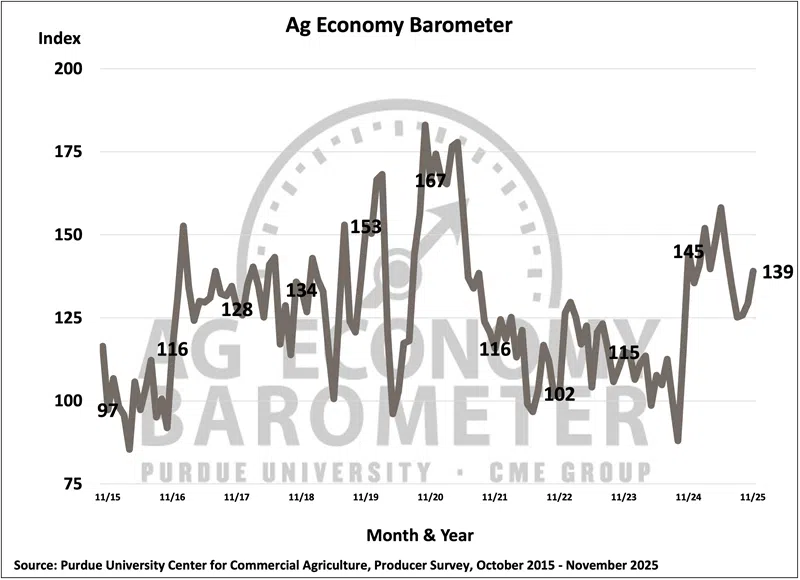

Farmer sentiment strengthened in November 2025 as rising crop prices and improved export prospects pushed the Purdue University/CME Group Ag Economy Barometer to 139—its highest reading since June. Much of the increase was driven by a sharp 15-point jump in future expectations, even as current conditions held steady. Financial outlooks improved alongside a 10–15% rally in fall delivery corn and soybean bids, helping offset weaker cattle prices in the livestock sector. Yet producers remain cautious: capital investment sentiment slipped further, and fewer farmers view today as a good time to expand. Long-term farmland value expectations reached a record high, while most corn producers anticipate stable cash rents heading into 2026. The survey also highlights shifting crop production strategies as growers respond to projected tight operating margins—considering lower-cost seed traits, reduced phosphorus applications, and adjustments to seeding and nitrogen rates.

Producers in November were more optimistic about their farms’ financial performance than a month earlier, as the Farm Financial Performance Index climbed 14 points to a reading of 92. In particular, the percentage of producers who expect better financial performance this year rose to 24% from just 16% in October. A sharp rise in crop prices from mid-October to mid-November was a key reason behind the expectation for better financial performance. For example, Eastern Corn Belt prices for fall delivery of corn and soybeans rose 10% and 15%, respectively, from mid-October to mid-November. The stronger financial outlook in the crop sector outweighed a weaker outlook provided by livestock producers, who were feeling the brunt of a decline in cattle prices that took place during the same time frame. Despite the stronger financial outlook, the Farm Capital Investment Index fell 6 points to a reading of 56, with just 16% of respondents saying now is a good time to make large investments in their farm operations.

Producers became more optimistic about future agricultural trade prospects in November. Responding to a question included in every barometer survey since January 2019, just 7% of respondents said they expect U.S. agricultural exports to weaken in the next 5 years, down from 14% who felt that way in October and down from 30% who expected exports to weaken back in March. In a related question, 47% of corn producers responding to the November survey said they expect soybean exports to rise over the next 5 years, while just 8% said they expect soybean exports to decline. The improved trade outlook appeared to contribute to this month’s sentiment improvement.

A majority of producers in November reported that they still expect to receive a supplementary support payment from USDA, similar to the 2019 Market Facilitation Program (MFP), but they were less confident of receiving the payment than in September. This month, just 16% of respondents thought an MFP payment was “very likely”, down from 62% who felt that way in September. Still, when the “likely” and “very likely” response categories are combined, just over three-fourths (76%) of farmers in November said they expect an MFP payment, compared to 83% who felt that way in September. When asked how an MFP payment would be used on their farms, 58% of respondents said they would use it to “pay down debt”, up from 52% who said an MFP payment would be used to reduce debt when surveyed in October.

For the second month in a row, the Short-Term Farmland Value Expectations Index rose, reaching 116 in November, 3 points above a month earlier and 10 points higher than in September. Farmers’ long-run perspective on farmland values also rose this month as the Long-Term Farmland Value Expectations Index climbed 4 points to a reading of 165, a new record high for the index. This month’s survey also asked corn producers about their expectations for cash rental rates for farmland in 2026. Nearly three-fourths of respondents (74%) said they expect rates in 2026 to be about the same as this year, which was very consistent with responses received in both July and August. The relatively strong cash rent outlook provides some support for farmland values.

The November survey again asked corn producers what adjustments to their production practices they anticipate making in 2026 in response to expected weak operating margins. Among producers who say they plan to make changes, the top two production practices they will consider changing are shifting to lower-cost seed traits or varieties and reducing applications of phosphorus. Next in line for possible changes are reducing corn seeding rates and nitrogen application rates. Still, a large minority of farmers (40%) said they don’t plan to make any changes to their corn production practices in 2026.

Recent barometer surveys have included two questions that focus on farmers’ attitudes regarding 2025’s policy shifts. A majority of respondents, 59% in November and 58% in October, said they expect that use of tariffs by the U.S. will ultimately strengthen the agricultural economy. However, that is lower than last spring, when 70% of respondents said they expected tariffs to strengthen the agricultural economy in the long run. More producers in recent months reported being uncertain regarding the long-run impact of the U.S. tariff policy. In October and November, 16% and 17% of survey respondents, respectively, said they were uncertain about the impact that tariff policy will have, roughly double the 8% of respondents who felt that way in April and May. Meanwhile, two-thirds (67%) of farmers in the November survey said the U.S. is headed in the “right direction”, down from the 72% who felt that way in October.

Comments