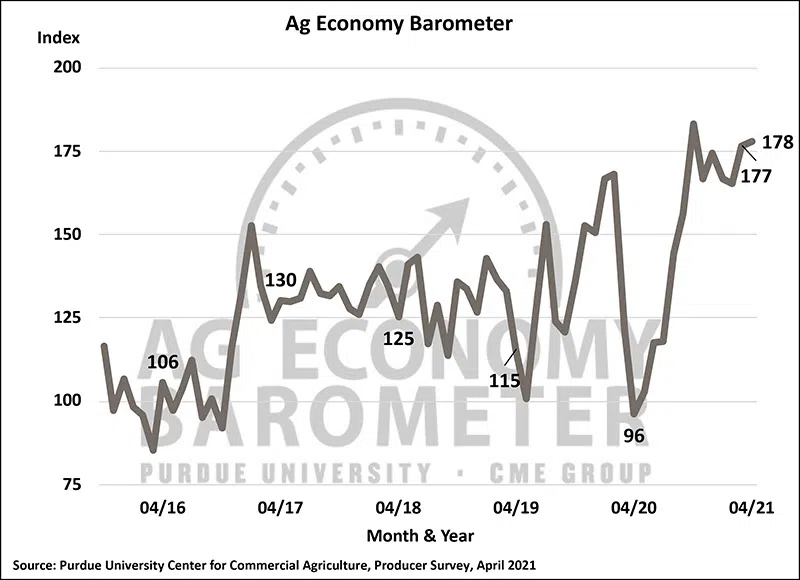

The Purdue University/CME Group Ag Economy Barometer was virtually unchanged in April, up one point from March to a reading of 178. Producers are becoming more optimistic about the future.

The Index of Future Expectations continued its upward trend from last month, up 5 points to a reading of 169. However, their views on current conditions slipped. The Index of Current Conditions dropped 7 points in April, to a reading of 195. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted April 19-23.

“The strength in commodity prices continues to drive improving expectations for strong financial performance, even as many are seeing rising input costs,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

Ag Economy Barometer remains strong; producers concerned about possible changes in estate tax policy. (Purdue/CME Group Ag Economy Barometer/James Mintert).

The Farm Financial Performance Index hit a record high in April, up 13 points from March to a reading of 138, 83 points higher than one year ago. This month 50% of producers indicated that they expect better financial performance in 2021 compared to 2020, up from 39% who felt that way in March. Despite expectations for their farms’ strong financial performance, farmers were less inclined to think now is a good time for large investments in buildings and equipment than they were in March. However, in a follow-up question, when asked more specifically about their farm machinery investment plans, more producers in April said they planned to increase their farm machinery purchases than in March.

“The divergence between the two responses could be reflective of the run-up in building costs and difficulty in scheduling construction projects across the U.S,” Mintert said.

Possible changes in U.S. tax policy are on the minds of ag producers. Ninety-five percent of respondents are either somewhat or very concerned that changes in tax policy will make it more difficult to pass their farms on to the next generation. Eighty-seven percent expect capital gains rates to rise over the next five years. Three-fourths said they are “very concerned” about the possible elimination of the step-up in cost basis for farmland in inherited estates and just over two-thirds (68%) of respondents said they are “very concerned” about a possible reduction in the estate tax exemption for inherited estates.

Farmers expect the rise in farmland values to continue unabated over the next year as the Short-Run Farmland Value Expectations Index rose to a record high reading of 159, 11 points higher than a month earlier. Producers were less optimistic, however, when asked about the 5-year outlook for farmland values as the Long-Term Farmland Values Expectations Index declined 9 points in April to a reading of 148.

“The difference in producers’ short- versus long-term expectations could be an indication that they are concerned that the rapid rise in farmland values we’re seeing may not be sustainable over the long run,” Mintert explained.

With COVID-19 vaccinations widely available across the U.S., attention is shifting to the percentage of the U.S. population that does not plan to get vaccinated. To learn more about commercial ag producers’ vaccination plans and compare that to the U.S. population at large, the survey asked producers about their vaccination plans since October 2020. The percentage of producers saying “they do not plan to get vaccinated” declined from a high of 37% in October to 28% in January and has fluctuated between 28%-32% since that time.

Polls from Monmouth University conducted in January, March and April indicate 21%-24% of U.S. adults will “likely never get the vaccine,” while a Pew Research Center poll from February indicated that 30% of U.S. adults would “probably” or “definitely” not get a COVID-19 vaccine. Comparing this month’s survey results to these broader population surveys suggests the reluctance to get vaccinated for COVID-19 among U.S. ag producers mirrors that of the larger population of all U.S. adults.

Following a nearly one-year hiatus, more in-person ag field days, workshops and educational events are being planned for 2021. On both the March and April barometer surveys, we asked producers if they are more or less likely to attend these programs than they were in 2020. Responses were mixed. Just over 70% of respondents said they are more likely to attend in-person events this year, but 28 to 35% of producers said they are less likely to attend in-person events. For program planners, this implies a need to offer programs in a hybrid or virtual format to reach the broad audience of commercial ag producers.

Read the full Ag Economy Barometer report. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results, available, and for even more information, check out the Purdue Commercial AgCast podcast. It includes a detailed breakdown of each month’s barometer and a discussion of recent agricultural news that impacts farmers.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

Comments