CZ Cattle Market Analytics analyst Ed Czerwien from Amarillo, TX, provides the following fed cattle recap for the week ending Sept. 11, 2021.

Fed cattle recap:

The feedlot cattle trades for WE Sep 11 were steady to 1 lower and the cash sales volume was slightly higher than the previous week.

The Five-area formula sales volume totaled 209,501 head compared to about 239,000 the previous week. The Five-area total cash steer and heifer volume was 58,580 head compared to about 50,000 head the previous week.

Nationally reported forward contracted cattle harvested was about 47,000 head this week and packers have 201,000 head for September. The nationally reported 15-30 day delivery purchases this week were 20,505 head along with about 16,000 head for the previous week.

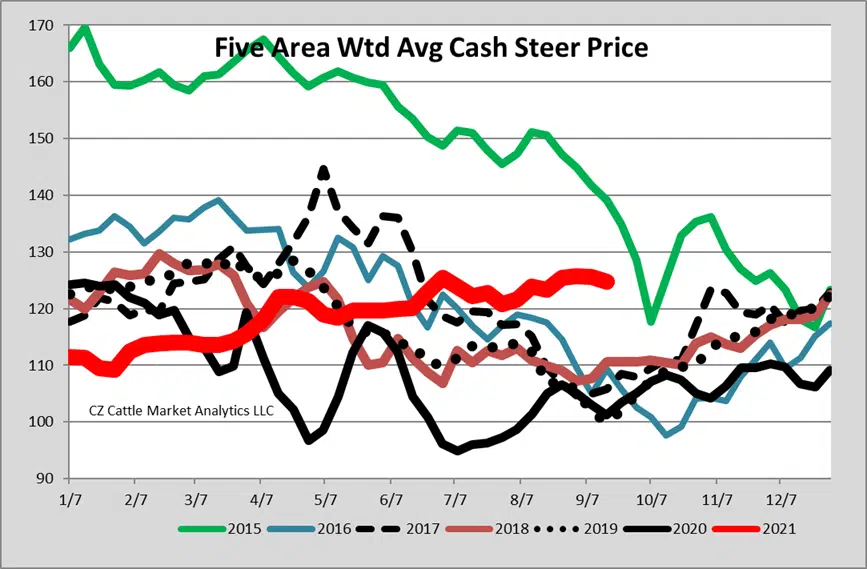

Now looking at the prices. The weekly weighted average cash steer price for the five-area region was $124.79, which was $0.82 lower compared to the previous week and last year the same week it was $101.21 which was about $1.90 lower that week last year. The same week in 2015 it was $139.18 even though the daily Choice cutout now was about 91 dollars higher than 2015, but in 2014 it was $160.84. This week the current five area weighted average live steer formula price was $127.47 and the live formula heifer price was $128.11.

The weighted average Five-area cash dressed steer price was $200.82 which was $0.97 lower. The five-area weighted average formula price which is steers and heifers was $202.82 which was $1.88 higher.

The estimated weekly total FIS cattle harvest for week ending Sep 11 was reported at 577,000 head and compared to 581,000 head the same week last year. The year to date total is still over 800,000 head higher than last year.

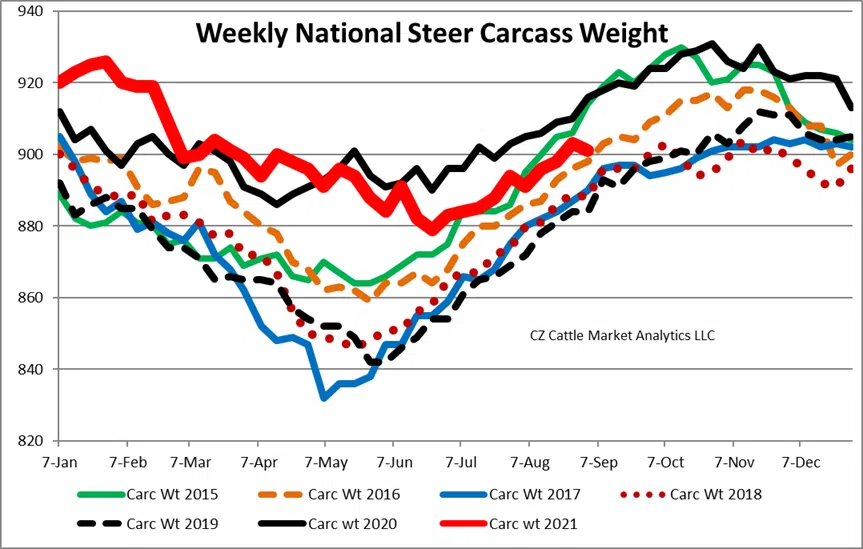

The latest average National steer carcass weight for WE Aug 28 was 901 lbs which was 2 lbs lower than the previous week and compared to 916 lbs the same week last year which 6 lbs higher than the previous week last year.

The feedlot cattle trades for WE Sep 11 were steady to 1 lower and the cash sales volume was slightly higher than the previous week.

The Five-area formula sales volume totaled 209,501 head compared to about 239,000 the previous week. The Five-area total cash steer and heifer volume was 58,580 head compared to about 50,000 head the previous week.

Nationally reported forward contracted cattle harvested was about 47,000 head this week and packers have 201,000 head for September. The nationally reported 15-30 day delivery purchases this week were 20,505 head along with about 16,000 head for the previous week.

Now looking at the prices. The weekly weighted average cash steer price for the five-area region was $124.79, which was $0.82 lower compared to the previous week and last year the same week it was $101.21 which was about $1.90 lower that week last year. The same week in 2015 it was $139.18 even though the daily Choice cutout now was about 91 dollars higher than 2015, but in 2014 it was $160.84. This week the current five area weighted average live steer formula price was $127.47 and the live formula heifer price was $128.11.

Infographic credit Ed Czerwien, CZ Cattle Market Analytics.

The weighted average Five-area cash dressed steer price was $200.82 which was $0.97 lower. The five-area weighted average formula price which is steers and heifers was $202.82 which was $1.88 higher.

The estimated weekly total FIS cattle harvest for week ending Sep 11 was reported at 577,000 head and compared to 581,000 head the same week last year. The year to date total is still over 800,000 head higher than last year.

The latest average National steer carcass weight for WE Aug 28 was 901 lbs which was 2 lbs lower than the previous week and compared to 916 lbs the same week last year which 6 lbs higher than the previous week last year.

Infographic credit Ed Czerwien, CZ Cattle Market Analytics.

Choice-Select spread on Friday Sep 10 was at 33.85 compared to 32.29 the previous week and that compared to 12.79 spread last year.

Boxed beef recap:

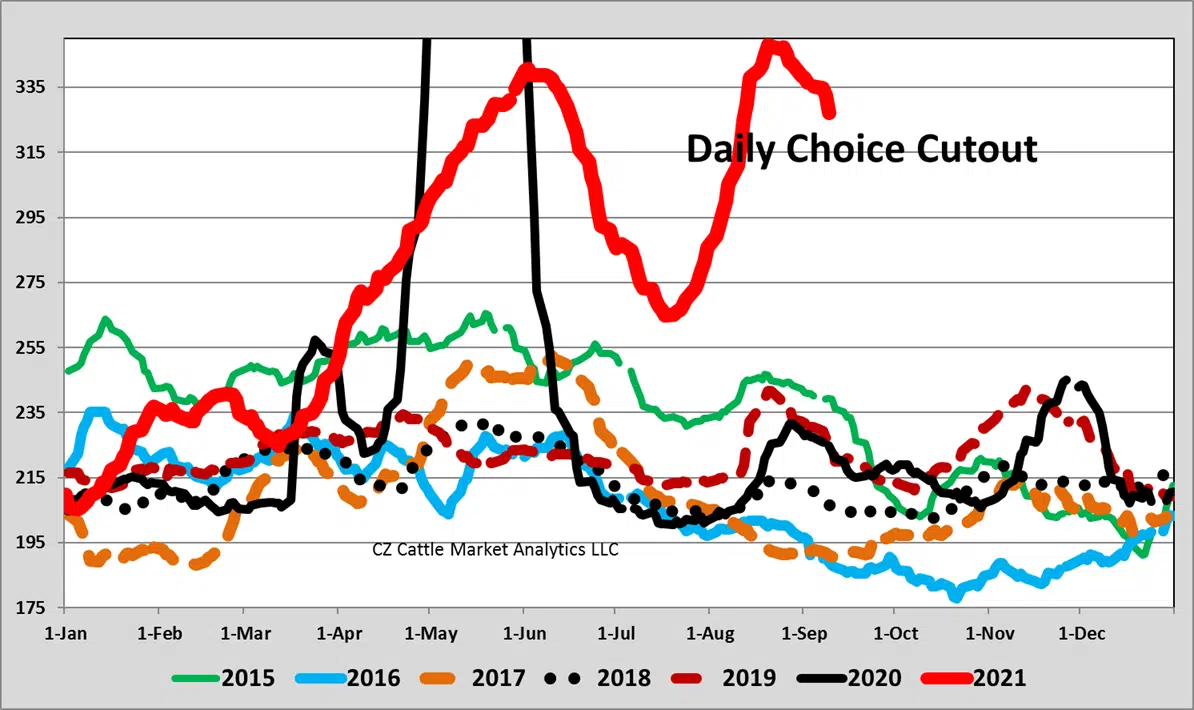

The daily spot Choice box beef cutout ended the week on Friday Sep 10 at $327.22 which was $9.20 lower compared to previous Friday so $18 lower during the last two weeks. Last year it was $219.89 on the same Friday, which was about $6.00 lower. During 2015 it was $236.09 on the same Friday so about 91 dollars higher now.

Infographic credit Ed Czerwien, CZ Cattle Market Analytics.

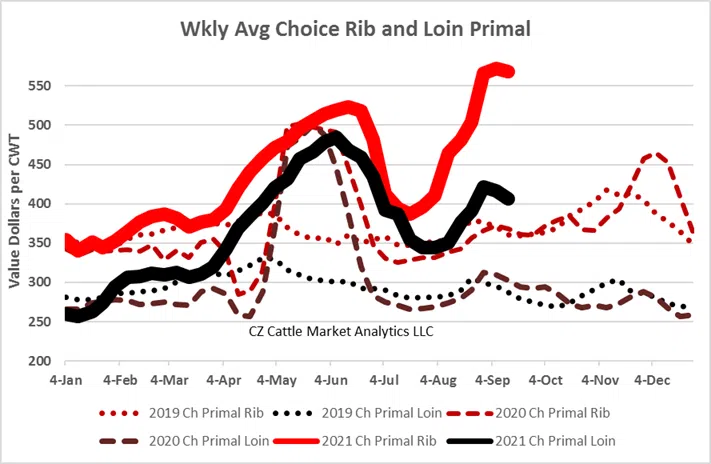

The Daily Choice Cutout is still much higher than all previous years now. This year the restaurants that have reopened and more family gatherings have really helped to push prices higher. The restaurants have pushed the Choice rib primal higher than ever with good demand for steak products along with great hamburger use now.

The end of this week the daily Choice Chuck and Round primal were 4 to 5 lower. The daily Choice Loin primal was 34 lower and the Rib was $6 higher so now about $234 higher during the last 10 weeks. The weekly total for the daily cutout was 514 loads and about 8 % of the weekly total loads sold.

The weekly average Choice cutout which includes all types of sales including the daily Choice cutout was 323.14 which was $7.13 lower but still much higher than all previous years now. However, like previously said the weekly average is following the daily cutout slowly which is always normal because many but not all formula sales are priced off of the previous week’s daily spot prices.

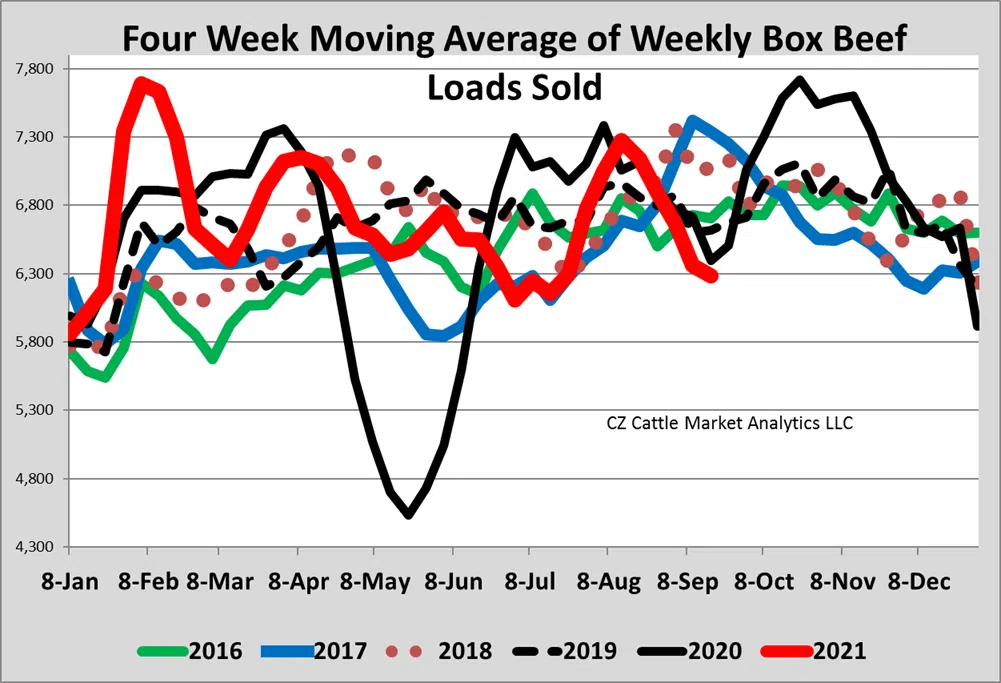

The total sales were 6184 total loads sold for the week which was 520 loads higher than the previous week. It has been lower the last seven weeks during the big price rally. Eight weeks ago, it was over 8000 total loads sold for that week which pushed the four-week moving average graph higher but then started to drop lower as you can see on the graph. That week over 8000 loads was helped by 1831 export loads that week but they have also dropped lately.

Infographic credit Ed Czerwien, CZ Cattle Market Analytics.

The out-front sales which get delivered after 21 days were 1355 loads which was 478 loads higher than last week. The largest out-front sales this week included about 1.2 million lbs of Choice inside Round product that was 49 dollars per cwt lower priced than the same current formula.

The exports as reported on the Box Beef report were 1039 loads which was 388 loads higher compared to the previous week. This week 118 loads were sold to our NAFTA neighbors and 921 loads were going overseas. These exports always drop lower when our prices are much higher than the global beef prices but the last two weeks of dropping prices finally increased these exports.

Formula sales were at 3341 loads which was 41 loads lower than last week and about 54 percent of the total loads sold this week.

Taking a look at the major primal cuts which impact the cutout value and the weekly average numbers include all of the different types of sales. The weekly average Choice Chuck and Round primal were 6 to 9 lower but still much higher than any time except last year during the medical epidemic. The weekly average Choice Rib primal was 5 lower and the Loin primal was 10 lower both were still helped some by the formula sales but will probably drop more soon. However, like previously said many times the Choice Rib always goes much higher ahead of the Prime Rib type cooking for Thanksgiving and Christmas parties, which has gotten bigger the last few years so after dropping down some it will rebound much higher.

Infographic credit Ed Czerwien, CZ Cattle Market Analytics.

The daily cow cutout ended the week on Friday Sep 10 was $ 0.55 higher at $235.54 and the 90% trimmings were at $279.79 which was only $ 0.03 lower compared to the previous Friday. The 90 % trimmings are about 68 to 70% of the cow cutout value, so it has the biggest impact on the cow cutout, and it has a big impact on wholesale ground beef prices so it also has impact on retail prices.

The latest report of Imported meat passed for entry into the U.S. for week ending Sep 04 showed 22,656 metric tons of fresh beef which was about 700 lower than the previous week and about 2300 lower than last year. The year to date total for these imports is 8% lower than last year so it continues to be much lower. The top 4 countries are Canada which is number one and is 11% higher than last year, Mexico is the second highest but 9% lower than last year, New Zealand is 7% lower, and Australia which is 43% lower.

Comments