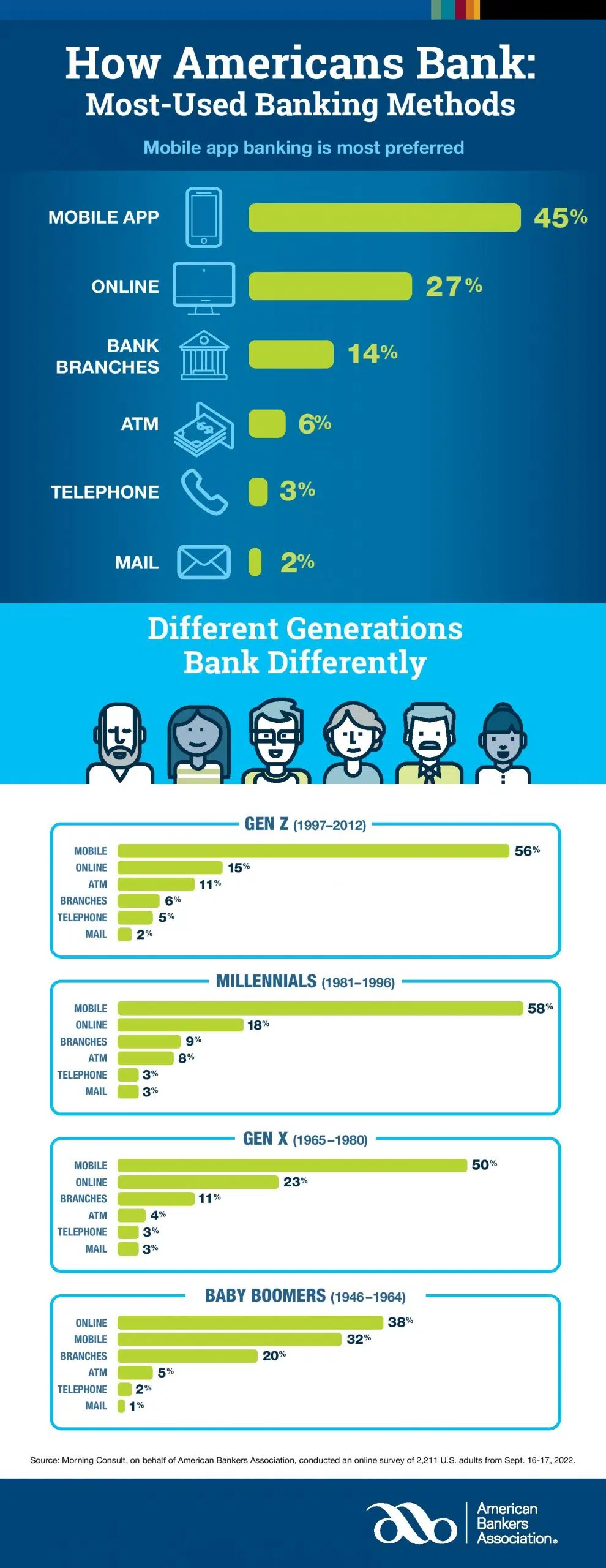

For the third year in a row, consumers are conducting their banking via mobile apps more often than any other method, according to a new survey conducted by Morning Consult on behalf of the American Bankers Association. The national survey found that consumers continued to embrace digital banking channels, with 45% of bank customers using apps on phones or other mobile devices as their top option for managing their bank account and 27% using online banking via laptop or PC the most in the past 12 months. Branch banking, which fell to 10% during the pandemic, increased to 14% at the expense of other channels such as ATMs (from 8% last year to 6% this year) and telephone calls (from 7% last year to 3% this year).

These findings are consistent with a recent FDIC survey that found the use of mobile banking increased sharply between 2017 and 2021, becoming the most prevalent primary method of account access.

“As mobile banking capabilities have evolved exponentially over the past decade thanks to bank investments in technology, we’ve seen many consumers become more comfortable embracing their phones and tablets to make everyday transactions,” said Brooke Ybarra, ABA’s senior vice president of innovation strategy. “When the pandemic made in-person interactions more difficult, even more people leveraged the easy-to-use technology at their fingertips to deposit checks, pay bills or send money to friends, and they haven’t looked back. At the same time, in-person branch visits continue to play an important albeit less frequent role for many bank customers, particularly when it comes to more complex transactions.”

A breakdown of age demographics shows different preferences among different generations. More than half of Generation Z, Millennials and Generation X use mobile banking apps most often, while a plurality of Baby Boomers most often utilize online banking (38%). One in 5 Baby Boomers (20%) visit bank branches the most often, while only 6% of Gen Z prefer to visit a branch.

ABA released an accompanying infographic highlighting the survey results. The data released today are the latest in a series of results gauging U.S. consumers’ preferences and opinions regarding banks and their services. ABA recently released additional survey data on major bank policy issues as well as data revealing that Americans are highly satisfied with their bank and variety of options, value credit card rewards and trust banks most to protect them from fraud and scams.

The full results for the survey questions are below.

About the Survey:

This poll was conducted by Morning Consult on behalf of the American Bankers Association from September 16-17, 2022, among a national sample of 2,211 adults. The interviews were conducted online and the data were weighted to approximate a target sample of adults based on age, race/ethnicity, gender, educational attainment, and region. Results from the full survey have a margin of error of plus or minus 2 percentage points.

Comments