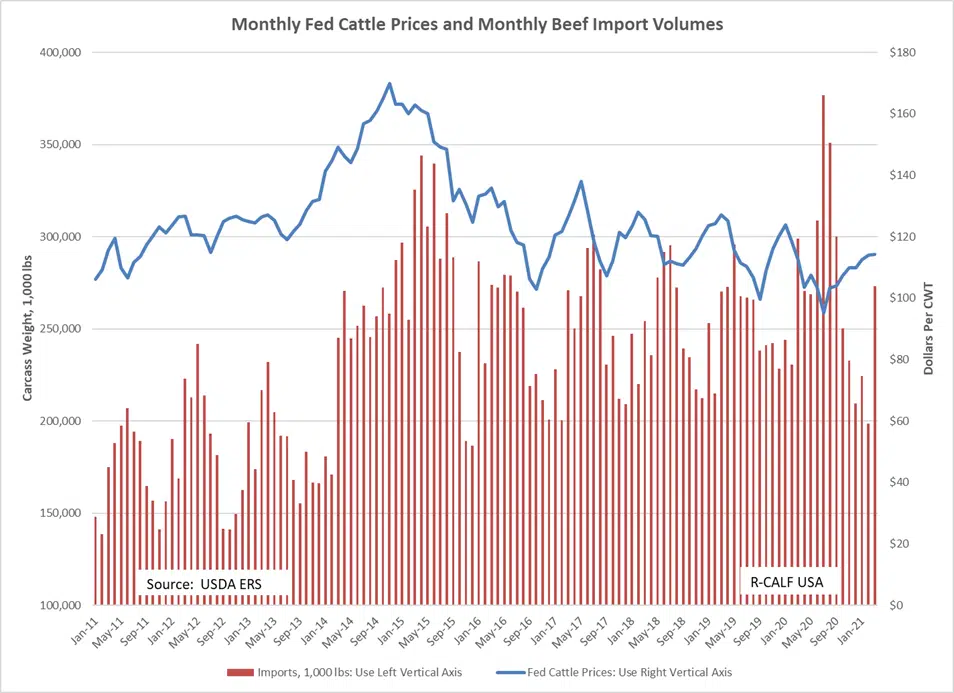

At over one billion pounds, the volume of beef imports in the third quarter of 2020 was higher than any third-quarter volume in at least the past two decades. This third-quarter 2020 spike in beef imports coincides with the lowest reported monthly price of fed cattle in over a decade, with the national monthly fed steer price at only $95.33 in July 2020.

R-CALF USA filed a lawsuit against the four largest beef packers in early 2019 alleging they violated antitrust statutes and other laws by conspiring to artificially depress fed cattle prices since at least January 1, 2015. Among the more specific allegations contained in the lawsuit is that the beef packers used live cattle imports to drive down domestic fed cattle prices.

But R-CALF USA CEO Bill Bullard says it is important to evaluate the potential effects of other conventional price-influencing factors that may well be exacerbating the impact of the alleged conspiracy.

R-CALF USA’s ongoing analysis of various price-influencing factors reveal fed cattle prices experienced four distinct troughs since their initial collapse six years ago, which began in early 2015 and continued through October 2016. According to Bullard, the lowest fed cattle price during each of those four successive troughs occurred during the third quarters in each of the years 2017, 2018, 2019, and 2020. And, as revealed in the chart below, each of those four successive troughs was associated with distinct increases in monthly beef import volumes.

“These data suggest that at least since 2017, there has been an inverse relationship between monthly import volumes and cattle prices, meaning low monthly cattle prices were associated with high monthly import levels and the record-high monthly import level in 2020 was associated with the lowest monthly fed cattle price in over a decade,” Bullard said.

He said R-CALF USA’s research reveals a similar inverse relationship between beef packers’ captive supply levels and cattle prices, wherein larger numbers of cattle purchased outside the negotiated cash market are also associated with lower cattle prices.

Bullard expressed concern that yet another consecutive import spike at or near the third quarter of 2021 could again blow the bottom out of the fed cattle market, which today remains inexplicably unresponsive to incredibly strong beef demand signals, in particular skyrocketing wholesale beef prices.

“This historical data show that cattle producers have not benefited from rising import levels,” he said.

“The U.S. cattle industry is at a critical crossroad and if decisive action is not taken immediately, we’ll soon reach the point of no return – the point when our industry becomes unrecognizable to those who are in it now,” Bullard concluded.

R-CALF USA is calling on Congress to take two immediate actions: Pass the Grassley/Tester bill (S.949) to restore competition in the fed cattle market by requiring packers to purchase at least 50% of their cattle in the open cash market and the reinstatement of mandatory country of origin labeling for beef to restore competition for beef produced from U.S. cattle.

Image credit R-CALF USA.

Comments