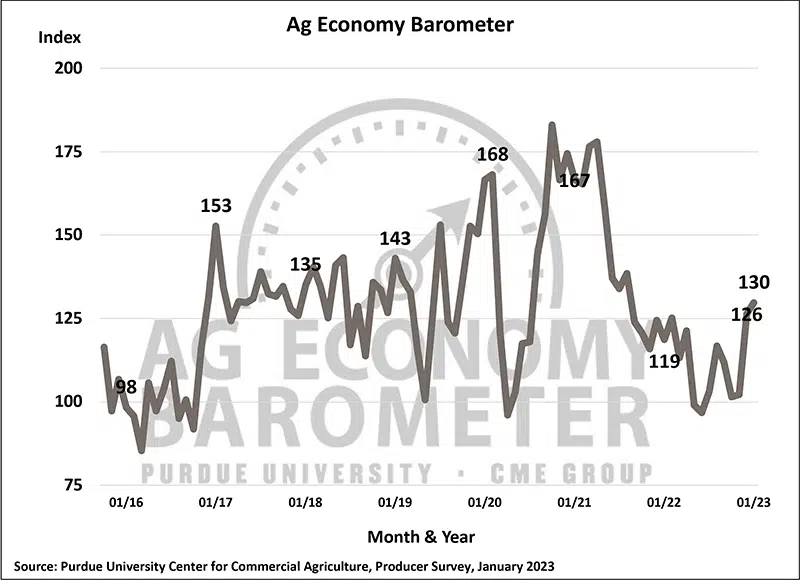

Following a sharp increase to close out 2022, the Purdue University/CME Group Ag Economy Barometer had only a modest increase in January, up 4 points to a reading of 130. The rise in sentiment was primarily attributable to better expectations for the future, as the Future Expectations Index improved by 5 points to 127. The Index of Current Conditions rose only 1 point to a reading of 136. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from January 16-20.

“Although producers were a bit more optimistic about the future this month, they again reported expectations for tighter margins in 2023 than in 2022,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

Improvement in farmer sentiment carries over into 2023 (Purdue/CME Group Ag Economy Barometer/James Mintert).

The Farm Capital Investment Index was up 2 points this month to 42; however, it remained 7% lower than a year earlier. Just over 7 out of 10 survey respondents said they think now is a bad time to make large investments in their farm operation. Among respondents who felt now is a bad time, 39% said high prices for machinery and new construction, 25% said rising interest rates, and 12% said uncertainty about farm profitability was the primary reason. Interest rates are becoming a bigger concern for farmers. As recently as November, just 19% percent of farmers in the monthly barometer survey chose rising interest rates as a key factor impacting their perspective on investments.

Each January, starting in 2020, the survey has included a question asking respondents if they expect to have a larger operating loan compared to the previous year and, if so, the reason for the larger loan. In January, 22% of respondents said they expect to have a larger 2023 farm operating loan compared to 2022, down from 27% last year. Among respondents who expect to have a larger operating loan, 80% indicated it was due to increased input costs, while only 5% said it was due to carrying over unpaid operating debt, which according to Mintert is important to note. The percentage of respondents who attribute their need for a larger loan to unpaid operating debt has fallen sharply since the question was first posed in January 2020. At that time, just over one-third of producers who anticipated needing a larger loan said it was because of unpaid operating debt. That percentage fell to 20% in 2021 and to 13% in 2022 before declining again to just 5% in 2023.

“The sharp decline in the percentage of producers expecting to carry over unpaid operating debt is important,” said Mintert. “It supports the idea that the vast majority of producers are entering 2023 in a strong financial position despite the rise in production costs.”

Producers’ expectations for short-term and long-term farmland values were mixed in January. The Short-Term Farmland Index fell 4 points to 120, down 15% when compared to one year earlier, as more producers said they expect values to hold steady over the coming year instead of increasing. The Long-Term Farmland Values Index rose slightly to 142 from 140 in December. Over the last year, the long-term index has declined just 2%, as producers continue to retain a more optimistic long-term than short-term view of farmland values. Among producers who expect to see farmland values rise over the next five years, the top reasons for their optimism continue to be non-farm investor demand (63%) and inflation (23%).

This month’s survey also included questions about leasing farmland for carbon sequestration, and U.S. farmers continue to express interest in carbon contracts. During the first quarter of 2021, approximately 7% of survey respondents said they had engaged in discussions with companies about being paid to capture carbon on their farms. When we repeated the question about carbon payments in August 2022 and again in January 2023, the percentage of producers who said they had discussed a carbon contract with a company rose modestly to 9% of respondents. However, relatively few farm operators have chosen to sign a carbon contract, with just 1% of January’s survey respondents indicating they had signed a contract.

Read the full Ag Economy Barometer report at https://purdue.ag/agbarometer. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results, available at https://purdue.ag/

Comments